Bitcoin's Climate Status (According to the Media)

When I tell people I run a company whose goal is to accelerate the energy transition using blockchain, I’m often met with a combination of skepticism, confusion, and opposition. “How can you possibly use the very technology that guzzles fossil fuels to clean up the energy sector, are you mad?”

Amidst an onslaught of sensationalist headlines and activist probes, Cryptocurrencies have quickly become environmentalists’ poster child for what not to do. Bitcoin especially, has been subject to a litany of thrashings, most often accused of using as much energy as (insert country here), and of reviving retired fossil fuel plants to power its energy-hungry fleet.

Last spring the world’s most high profile and controversial CEO, Elon Musk, denounced Bitcoin’s energy impact and suspended Tesla’s BTC payment feature in a crippling blow to Bitcoin’s PR. The world took note and the media lapped up the click-bait windfall.

This was the first of a cascade of governments following suit: China excommunicated its miners in July last year claiming environmental concerns; Kazakhstan rationed power after miners overtaxed the power grid, requiring the country to import auxiliary power and descending the country into political turmoil; and Kosovo announced a blanket ban amid a local energy crisis.

Bitcoin has even caught the attention of the political elite, with US Senator Warren prompting the investigation of several mining companies’ energy footprint, and with US Congress holding a hearing specifically to dissect the environmental externalities of Bitcoin mining. Almost across the political spectrum, Bitcoin is painted as a miscreant in need of a thorough dressing-down. And with sensitivities already high over this increasingly politicized subject, it’s not at all shocking that the general impression is that cryptocurrencies = environmental destruction.

But First, Does Bitcoin Even Matter?

About 2 billion people in the world celebrate Christmas. This means that Christmas lights, whose annual energy footprint is approximately the same as Bitcoin’s, could at most, be relevant to one quarter of the world. And yet, we don’t see Senate hearings evaluating the value of seasonally ornamental lighting, or environmentalists up in arms over the carbon footprint of their power source. Point is: just because you don’t care about a thing, doesn’t mean it isn’t a thing.

At 114 million active users, Bitcoin’s loyal users present a scale larger than the populations of Canada and the United Kingdom, combined. And at a market cap ranging between USD $815 billion and $1.26 trillion – comparable to the values of each of Facebook, Amazon, Tesla and Berkshire Hathaway – it is becoming harder to turn a blind eye. In my humble opinion, any new innovation that keeps company with the world’s most influential companies and provides enough value for two large countries-worth of people, is certainly worth some attention.

Let's Get Some Perspective

Many who misunderstand its technical mechanics claim Bitcoin’s electricity consumption speaks to an inefficiency that must be ‘upgraded’. But famous asset manager, ARK invest contends that “influential financial research institutions are dismissing bitcoin based on stale information, incoherent arguments, and flawed analysis”. Indeed, Bitcoin’s computational demand is entirely deliberate, a ‘feature, not a bug’, and is the precise characteristic that enables Bitcoin’s unprecedented decentralized security.

This novel security feature is what makes it a once-in-a-generation innovation, and like most things we value, Bitcoin uses electricity. But perhaps as a product of being la mode nouveau, or thanks to its unique transparency, it seems to be held to a higher standard of account than pretty much all other sectors.

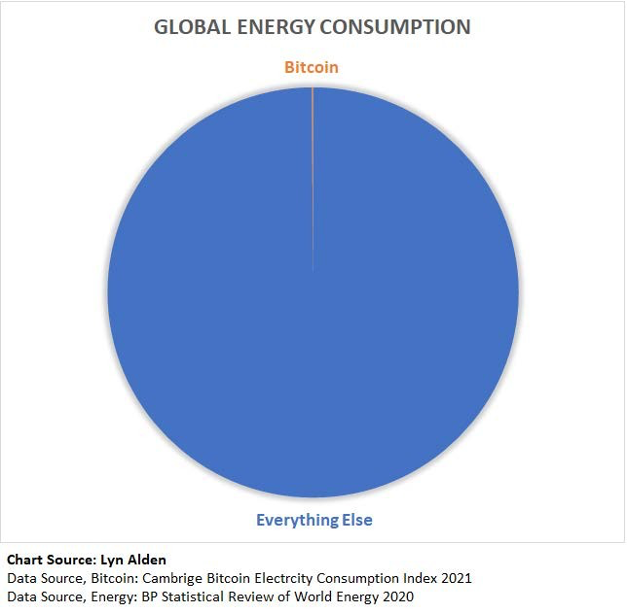

It is true that Bitcoin’s current annualized footprint is approximately that of Argentina; but it is also only 1.7% of the electricity consumption of the US and only 0.7% that of China. Let’s unpack what that actually means. At an annualized estimated peak of 204 TWh per year as of January 2022 (albeit, 2021 averaged at only 125 TWh), the network consumes approximately 0.08% of the world’s electricity. That is less than one tenth of one percent. Are we really all up in arms over a demonstrably valuable innovation whose energy footprint is effectively a rounding error?

After all, energy associated with Bitcoin mining is roughly equivalent to the energy consumption of zinc mining and refinery and 2.5 times less than the energy associated with the extraction its store-of-value cousin, gold – except it doesn’t destroy large swathes of natural resources and local communities to get it (to call out the ‘S’ part of ESG). Bitcoin consumes roughly the equivalent of the energy consumed by running household tumble driers in the U.S. alone, and one fifth the energy used for domestic refrigeration. Since we know that humans are notoriously bad at understanding large numbers and we’re already comparing Bitcoin to Argentina, gold mining uses 2.5 Argentinas and US household appliances 15 Argentinas! If you challenge that these are both essential goods, consider that Bitcoin is also on par with the cruise line industry and private jets – neither of which are especially strong in the E, S, or G department. And yet, they continue unabused.

For the sake of a sector reference, an apples-to-apples comparison of the energy usage of the global financial system leaves Bitcoin triumphing again. The global financial system has a market cap of approximately USD $8.6 trillion, and Bitcoin is hovering at USD $850 billion as of this writing of this article. With the banking system using approximately 573 TWh per $1 trillion of value, Bitcoin uses 2.5x less than the energy required for the same amount of financial value.

Source: Pareto Technologies “Mining Mutualism”

And for another dose of reality...

Energy production and transmission are two incredibly wasteful processes. According to the Energy Information Administration (EIA), 66% of primary energy used to create electricity is wasted by the time it arrives at the customer. On top of that, renewable energy curtailment, which can be to the order of 5-25%, deliberately restricts perfectly good clean energy from the grid thanks to congestion issues. Similar to a traffic jam on a freeway, curtailment occurs when there is excess supply trying to access the grid, relative to local demand. Due to the combination of intermittent nature of wind and solar energy – the sun sometimes shines and the wind blows at moments when energy isn’t in need – and overtaxed transmission lines, curtailment is required to balance loads. This economic dis-incentivization forces solar and wind projects to sell energy at low – and in some cases financially unsustainable – prices because of the lack of options or competition with other projects. Parts of China (especially those which were formerly littered with Bitcoin miners) have such a surplus of hydro and wind power that the curtailment rate regularly exceeds 20%, a figure that singlehandedly could could power the entire Bitcoin network…if they reopened their borders.

Critics of Bitcoin mining tend not to be experts on electricity physics, regrettably exposing it to an array of ill-informed attacks, like ‘stealing’ power from households. Evidently unbeknownst to the House of Representatives – in spite of all their resources…and Google – electricity has a diminishing return on transmission, limiting its useful radius. Electricity infrastructure is geographically constrained, leaving pockets of negatively priced energy routinely available on the grid with no associated demand. A signal of energy overabundance, negatively priced energy has become the norm in many parts of the US, leaving stranded islands of energy with no nearby buyer.

And with renewable energy following a Moore’s law-type trajectory over the past decade, renewables are trending towards uneconomical for devleopers. Since 2010, costs have dropped by a factor of 10, with solar seeing an average annual growth rate of 42%. Even excluding subsidies, new onshore wind and solar photovoltaic projects are cheaper alternatives to both natural gas and coal-fired power plants, according to the US Energy Information Administration. Unsubsidized costs of solar and wind energy are now 3-4 cents/kWh and 2-5 cents/kWh, respectively, which position them as cheaper than their fossil fuel counterparts, coal and natural gas, each around ~5-7 cents/kWh. Once we combine solar, wind and batteries to produce surplus energy, this will lead to a superabundance of electrons, which is great for the environment, not so great for the producers. It’s a catch 22: the dematerialization of renewable energy presents opportunities for ubiquitous sustainable power, but current economic disincentives jeopardize the exclusive adoption of renewables. Enter: Bitcoin.

Where Bitcoin Actually - Helps

“Bitcoin miners are using electricity that would otherwise have been wasted; they go to the end of the earth, the end of the grid to recycle marginal energy” – Michael Saylor.

Interestingly, only three months after Bitcoin’s whitepaper was published in 2009, the recipient of the first-ever Bitcoin transaction, computer scientist Hal Finney, raised the concern of potential CO2 emissions. But back then, both a renewable-powered grid and zero marginal cost energy were distant fantasies. The truth is: “Bitcoin is an especially elegant use of electricity. By design, it cannot use more electricity than the value it provides. The network continues to be more energy efficient each year due to pre-programmed declining block subsidies, resulting in structural disinflation”.

Insofar as the US energy mix for miners, they sit at approximately 68% renewables, with the global average at 56% according the to the Bitcoin Mining Council, greater than most country’s national grids. The reason: Bitcoin miners are idiosyncratic energy buyers. “They can tolerate load interruptions, co-locate next to estranged facilities, and can absorb otherwise wasted production, constituting them an extraordinary asset to the energy economy; an energy buyer of ‘last resort’”, says the Bitcoin Clean Energy Initiative. As it happens that Bitcoin is often a scapegoat for rising fossil fuel consumption, the opposite is in fact, the case. Cryptocurrency mining in general can actually drive renewable energy project feasibility, increase electricity access, and absorb excess carbon from the atmosphere. For those uninformed of the mechanics of the power system, this may all sound rather counterintuitive, and certainly counter to the soundbite headlines you’re familiar with. But believe it or not, Bitcoin miners are truly energy vanguards. To debunk the narrative that Bitcoin ‘steals’ energy from more important consumers, we must first understand the technical ingenuity behind the network itself. Bitcoin miners are unique compared to most other energy buyers, as mining is not crippled by inconsistent power access. This is because each block computation is statistically independent from the last one, meaning that the process of mining can be stopped on-demand without a loss of progress. Compared to other energy intensive computing processes like server farms, Bitcoin can stomach disruptions in the field without affecting the uptime of the network materially. Unlike households, commercial businesses and industrial activity, Bitcoin doesn’t mind if we take a little power time-out. Not so true for the average city dweller. This remarkably flexible load allows miners to engage in a ‘demand-response’ relationship with energy producers that actually aids in grid resilience. It begets an entirely new energy buyer dynamic; one that acts to absorb excess energy as energy operators reckon with intermittent supplies of renewable energy. According to John Belizaire, the founder and CEO of Soluna Computing, this feature makes miners the ideal complementary technology for renewables and storage, providing a stronger value proposition for scaling deployment and accelerating the transition to renewables. Insofar as the argument that mining “drives up energy prices”, it’s important to consider terrestrial limitations when lashing out at your neighbourhood energy villain. There are many parts of the world that serve as optimal energy beacons but are far less favourable for domestic dwelling. Rural Sichuan, China would be a great example, where the rivers run heavy and the hydro energy streams in excess, but is not especially popular for domestication, sadly relegating them to abandonment or fringe use. But Bitcoin miners have the peculiar benefit of being location agnostic, meaning they are port themselves next to rural power giants or otherwise fallow resources. Seeking cheap power, they are willing to scoop up stranded power and rescue the economics of wind and solar installations that might otherwise be uneconomical. Co-locating next to these stranded assets optimizes against transmission losses by simultaneously making use of power that would otherwise have been wasted, and mitigating dissipation. A far cry from driving up prices, if a miner is buying energy that no one else wants, I say they’re more like energy heroes. And beyond simply profiting where others prefer not to, they can act as an on-ramp buyer – they serve to fortify the grid, making new renewable available until grid congestion is resolved or industrial customers move in. Visualize -- an energy Pac-man scooping the leftover energy. Another benefit to co-location is that miners can offer an economic boost to renewable producers during times of curtailment. Electricity generation that would otherwise have been wasted, can become a second source of profit for power producers. Purchasing energy ‘behind-the-meter’ means they are not subject to grid congestion challenges, and acts as an alternate revenue stream to incentivize production. It also creates a price floor which gives energy providers increased bargaining power with buyers. If utilities insist on charging egregiously low rates, energy projects could turn to low-cost cryptocurrency mining for profitability. This means Bitcoin presents an unprecedented opportunity for developing areas to build new capacity where economics are disincentivizing to developers. Miners can bridge this gap by providing immediate profits until that electricity is ready to be imported into the grid or put to better use, acting as revenue diversification against curtailment, and allowing wasted power to be turned into a second source of income. Lastly, in the US specifically, mining solves an urgent climate problem: its flared gas disaster. Flared gas is a common response to unprocessed natural gas that tends to live near petroleum deposits. Often the gas is found in insufficient quantity to make it economical to build transport networks to convert into energy, so it is simply released into the atmosphere. This is done by either directly venting the highly potent menthane gas, or burning (flaring) it to convert into CO2. If you guessed that this is an shockingly wasteful and polluting by-product of petroleum mining, you’d be correct. The US Energy Information Administration estimated that 1.48 billion cubic feet of natural gas was vented or flared per day on average in the United States throughout 2019. The translates to 150 TWh of natural gas flared per year, which is greater than the annualized peak of Bitcoin in 2021. What this means is that flared gas, otherwise quite literally wasted (and contributing to greenhouse gas emissions), could have theoretically powered the entire Bitcoin network without any new energy being produced. It feels like a win/win/win: producers monetize wasted gas, miners get super cheap energy, and the environment gets lower potency greenhouse gases. If anything, stranded gas miners are closer to carbon sinks than carbon sinners.

E - S - G (Environmental, Social, Governance, for those who aren't climate geeks)

And if we’re really going to get our knickers in a knot about the ‘ESG’ implications of blockchain, needn’t we remember the S and the G part of that acronym? It feels like these two letters are conveniently forgotten when Bitcoin’s energy consumption is flagged. In my view, the social implications of Bitcoin make it among the most important cultural innovations of all time. Up there with democracy and the internet! With an unprecedentedly high positive sum for the potential of social inclusion – banking the unbanked, acting as an inflation hedge in runaway economies, and enabling a bypass against monopolist and centralized controls – all with arguably zero social costs, Bitcoin makes gold look criminal. Some 70% of the citizens of El Salvador are unbanked according President Nayib Bukele, but most own a phone. Accordingly, they can use a mobile bitcoin wallet that thanks to Bukele’s maverick moves, they are plugged into a worldwide monetary system for the first time.

And I mean, consider you are living in Venezuela or Turkey right now. Are you feeling confident in your government to protect your future or your livelihood when the value of your paper bills disintegrates before your eyes? I think not. Even in the US, at the current 7% inflation rate, holding paper money literally costs you money. Wage increases only grow at about 2% per year (if that), meaning 5% of your cash literally disappears by next year. You want to talk social value, Bitcoin’s algorithmically-defined anti-inflationary monetary policy is one hell of a solution. Next, on the Governance side of things, Bitcoin has no decision-makers. Bitcoin is operated by computer code, and is open source, allowing for a hard fork whenever the community decides its policy runs amok. Imagine a country that could simply split off into financial independence whenever the Central Bank got a little print-happy. Bitcoin is for all, and whether you have 0.00001 BTC or 10,000 BTC, the rules are the same, and you have the same benefits. There is no insider information or privileged access. No Cantillion Effect here. Bitcoin is open-source for all to review, to see, and to challenge. Computer code does not discriminate by faith, sex, creed, gender, and does not reproduce to serve its hegemony or elite. Indeed, its originators remain anonymous. How Bitcoin Can Lead the Charge in the Energy Transition

All of the above considered, it would be fair to take issue with the energy war against Bitcoin, appealing for Bitcoin’s opponents to simmer the heat. Simply being the new kid on the block, and a more transparent one at that, shouldn’t mean bitcoin should carry the highest energy burden -- but why not accept it? Why not use the profile and exposure to create a movement towards green? To set the standards for other sectors to transition, to use this platform to lead rather than defend? Being en vogue does offer a heightened platform for setting best practices, and we are due for a real leader in this space. Since our governments and corporations are clearly not cutting it.

As we’ve established, Bitcoin mining presents an unusual opportunity to accelerate the energy transition to renewables. Despite being the cheapest sources of energy worldwide, solar and wind are hitting deployment bottlenecks primarily because of their intermittent power supply and grid congestion, and not many solutions lend better towards addressing these challenges than Bitcoin. By allowing grids to deploy enough renewables to cover our power needs, Bitcoin helps in cutting costs, drawing us closer to zero marginal cost energy production.

But because Bitcoin pioneers are really truly some of the most forward thinkers on the planet, they’re going even further to advance the climate cause. Several leading crypto initiatives are trying to accelerate the shift to renewables. The Crypto Climate Accord is currently working to ensure the cryptocurrency industry shifts to 100% renewables by 2030. Twitter and Square CEO Jack Dorsey announced in December 2021 the launch of Square’s Bitcoin Clean Energy Investment Initiative, a $10 million fund to support companies that help drive the adoption of renewables within the Bitcoin ecosystem. The Sustainable Bitcoin Standard verifies and rewards miners for using renewable sources, and the Blockchain & Climate Institute is a think-tank to identify best practices for applying blockchain to climate solutions.

More immediate, investment capital is hungry for commitments to utilize 100 percent green energy in crypto mining operations. Gryphon Digital Mining recently raised $14 million to establish US-based green energy mining operations, and Elite Mining completed a Series A offering to develop a model for clean energy to be used at scale.

An asset that was once accused of accelerating climate change may play a role in stopping it by helping to empower clean and low-cost solutions. So let’s get behind the #MakeCryptoGreen movement, not the Luddite #BanCrypto one. Don’t be like Larry. Let’s not miss out.

コメント